Peter Thompson

Peter graduated from Lasalle College in hospitality and spent 13 years managing the infamous Chateau du Lac, where he built a reputation for leadership and forming genuine, trusting relationships.

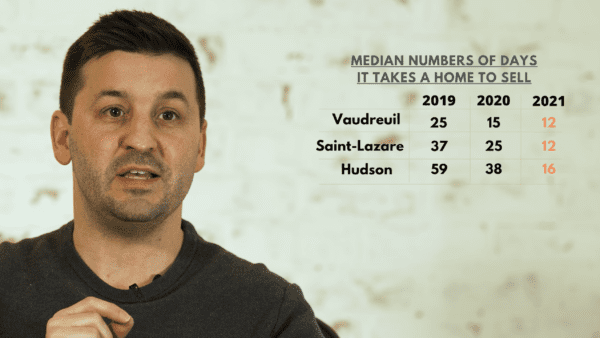

Peter’s real estate career is built on a foundation of honesty, trust, and tireless effort. He takes pride in going above and beyond to ensure his clients feel supported and confident throughout their journey. He regularly provides timeline market insights on his local service areas of Saint-Lazare, Hudson, Vaudreuil, and Rigaud, but has expanded to service clients across the Vaudreuil-Soulanges and West Island regions.

Outside of work, Peter’s world revolves around his wife and two young boys, who inspire him every day. A die-hard Montreal Canadiens fan, Peter never misses a chance to cheer on the Habs or crack a dad joke to keep everyone smiling.